No new applications for import into the EU in 2021

7 April 2022 / No new applications were registered in 2021 for the import of transgenic plants into the EU – the first time this has happened. The European Food Safety Authority EFSA was initially set up in 2004, and has since then received more than 150 applications for the market approval of transgenic plants. It appears that new applications were still being registered each year up until the end of 2020, although in noticeably fewer numbers. Possible reasons for the decrease: the cultivation of transgenic plants is stagnating in many growing regions; for decades there have been hardly any plants with really new traits, and, in addition, numerous risk-related issues remain unresolved.

Concerns about transgenic plants have increased within the last few years. The EU Parliament has, for example, adopted around 60 resolutions against these imports (just yesterday, another resolution was adopted). In the EU, large supermarket chains have consistently tried to avoid selling food produced using transgenic plants. Countries growing transgenic plants have also been heavily criticized for, amongst others, using large amounts of pesticides and the destruction of the rain forest in order to grow even more crops. In addition, there are indications that transgenic plants can cause the spread of pest insects.

Currently around 90 import approvals have been issued in the EU, of which only one approval includes cultivation. Around further 30 applications for import are still pending. Most of them cover the harvest from soy, maize, oilseed rape, sugar beet and cotton that are resistant to herbicides and produce insecticides.

In recent years, companies such as Bayer (Monsanto), Corteva (Pioneer/DowDuPont), BASF and Syngenta (ChemChina), have mostly filed import applications for so-called ‘stacks’. Stacked crops are produced by crossing genetically engineered plants to combine several traits. Resulting plants often inherit several resistances to herbicides and produce up to half a dozen insecticides. Unlike the parental plants, no new patent protection is granted to cover stacks. This is likely to be a contributory factor in the lack of interest from large companies.

The EU market has for many years only been of interest to the genetic engineering industry in regard to animal feed imports. Companies withdrew most applications for the cultivation of transgenic crops in the EU a long time ago. However, transgenic plants are still being grown on a large scale, especially in North- and South America. Therefore, the amounts imported into the EU are not likely to be reduced substantially in the near future. In particular, millions of tons of soy and maize are imported as animal feed every year. Nonetheless, the boom expected in previous years seems to have finished.

If and to which extent the global cultivation of transgenic plants will decrease within the next few years is difficult to predict. Even if the companies drop this business completely, future generations will still have to deal with the problems: transgenic plants are currently spreading uncontrolled in several regions, including beyond the fields. In addition, imports to the EU are very often found to be contaminated, often with transgenic plants that were either never approved or have not been grown officially for many years.

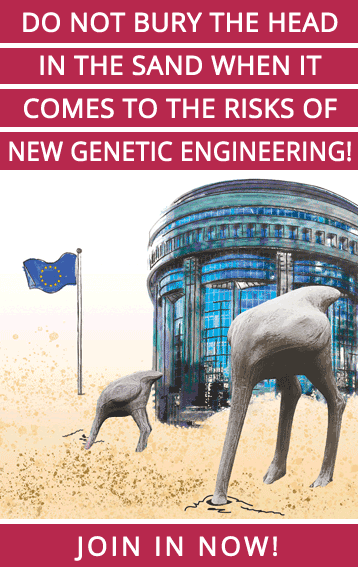

Aside from existing transgenic crops, the debate on genetically engineered seeds will continue in the agricultural community: large companies are showing an increased interest in new genetic engineering technologies and CRISPR/Cas. In particular, Corteva (previously DowDuPont) has already gained a dominant position with patents on gene scissors technology. However, an application for approval has so far only been filed for one of the Corteva plants (more specifically its subsidiary, Pioneer) for the EU market.

Contact:

Christoph Then, info@testbiotech.de, Tel +49 15154638040